Ottawa 30 second Real estate market update

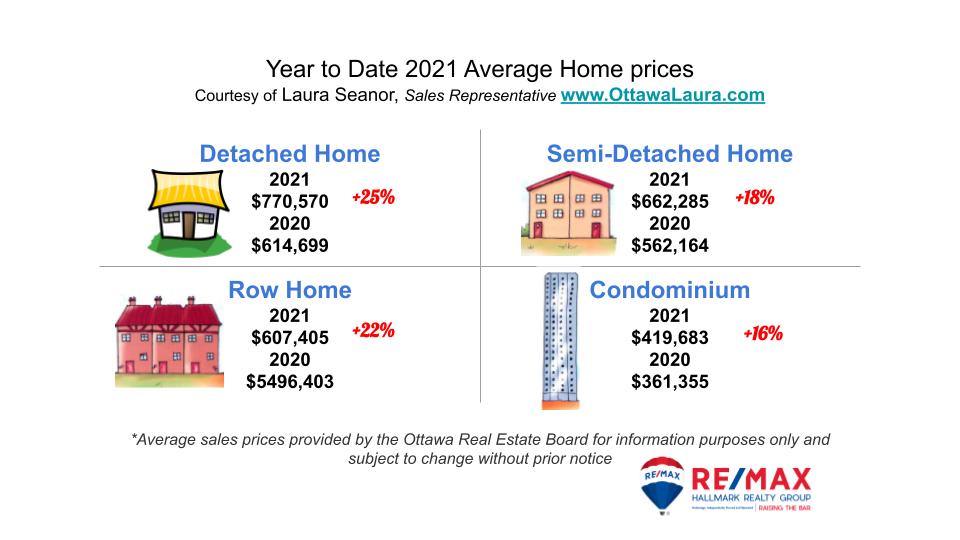

PRICES:

Prices have continued to increase

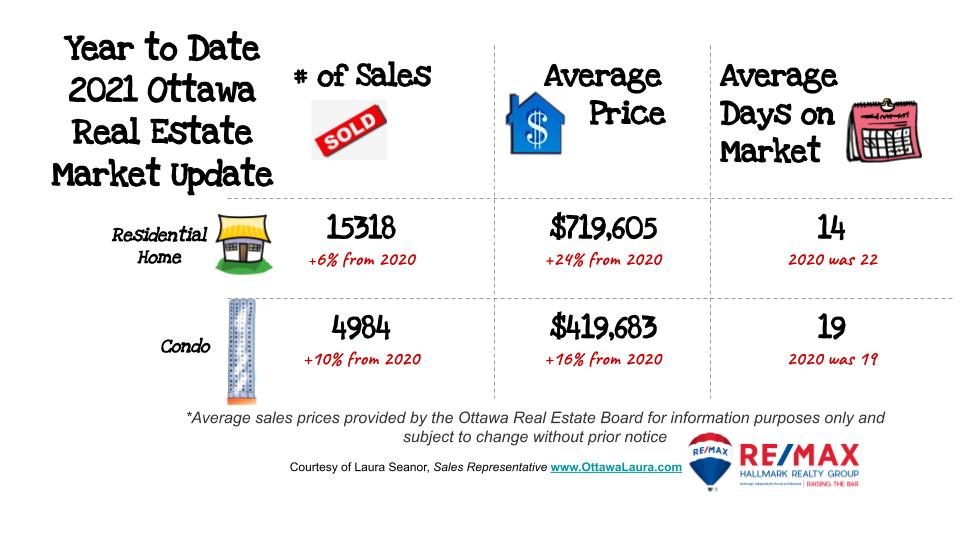

Overall in 2021 residential homes have increased 24% and condos have increased 16%

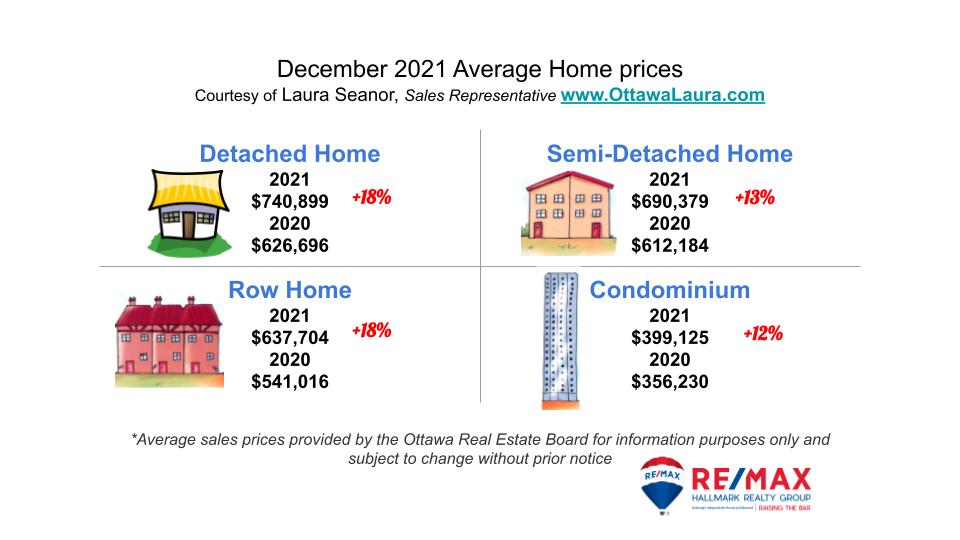

December 2021 saw the following increases over December 2020

+25% for single family homes

+16% for condos

+22% for Row homes

+18% for Semi-detached

SUPPLY:

600 New Listings

Compared to 745 December 2020

DEMAND:

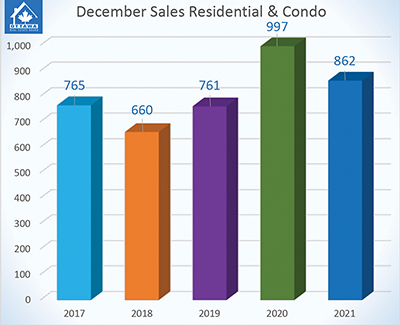

862 residential properties sold this past December

5 year average is 809

What it means

While we saw a slight break in the market over the summer months. The demand continues to exceed the amount of properties that are available to purchase.

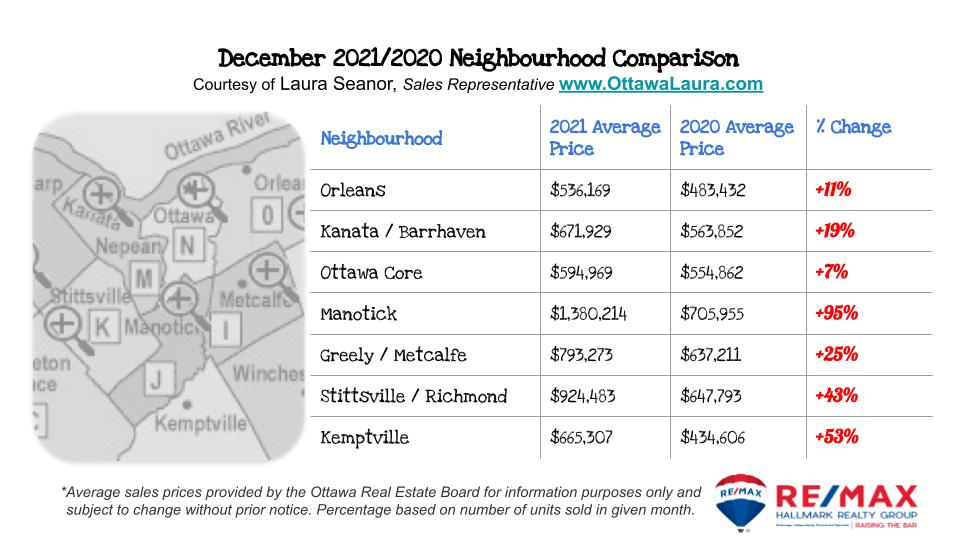

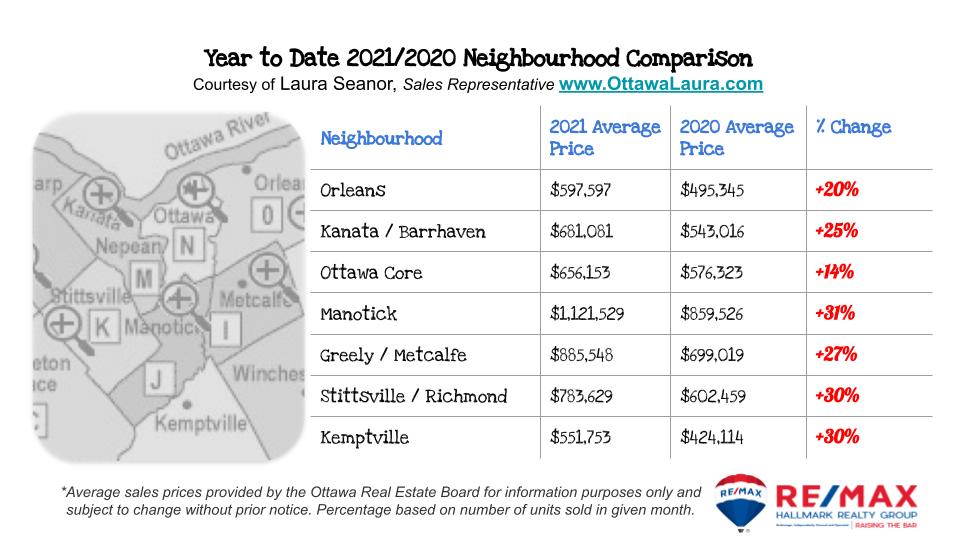

Neighbourhood increases

Carp, Manotick, Alexandria & Westport all saw a decrease in the number of sales however these communities saw some of the largest price increases.

In general the number of sales increased 7% and the prices went up 13% (including all communities and both residential homes & condos)

In terms of affordability the downtown core had the smallest price increase over the 2021 year. Most other communities had a price increase of 20% plus. If you are curious about a specific community, feel free to send me a note.

What to expect in this month?

The number of sales in January is usually slightly above or close to the number of sales in December

The number of new properties that are listed will start to increase each month as we look forward to the Spring market.

Big banks and mortgage brokers are still indicating that the interests will continue to climb throughout the 2022 year.

If you are thinking about selling, it’s a good time for us to start your preparations and put together a rock solid marketing plan.

If you are thinking about buying, have your mortgage approval in hand and get ready for right house to become available. With many buyers focused on virtual learning over the next month, it will most likely be the ideal time to find your home with the least amount of competition.

Whether you are buying, selling or both I’ve got the strategies and plans for you…all you have to do is reach out 😉

I’m here to help!

Laura Seanor

RE/MAX Real Estate 🏡

________________

Ottawa 30 second Real estate market update

Do you have questions about what it takes to successfully sell or buy in Ottawa, Canada? DM me or text/call 613-290-0407

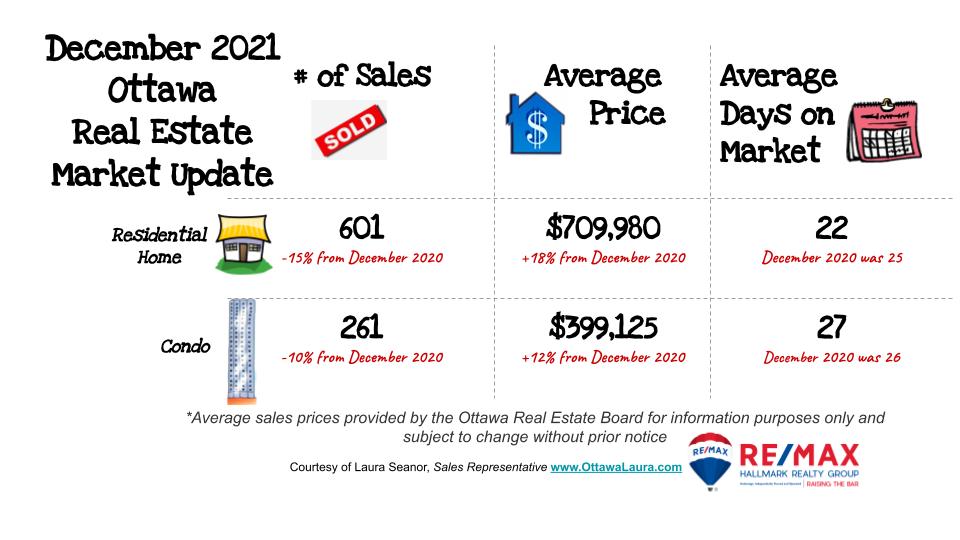

2021 Resale Market Normalizes and Breaks Records

Members of the Ottawa Real Estate Board sold 862 residential properties in December through the Board’s Multiple Listing Service® System, compared with 997 in December 2020, a decrease of 14 per cent. December’s sales included 601 in the residential-property class, down 15 per cent from a year ago, and 261 in the condominium-property category, a decrease of 10 per cent from December 2020. The five-year average for total unit sales in December is 809.

“December’s resale market performed as it typically does with a marked decrease in sales from November as families turned their attention towards the holiday break. Although slightly above the five-year average, the number of properties exchanging hands was lower than the year before due to the atypical market we experienced in 2020 when peak market activity shifted to later in the year because of the initial spring pand emic lockdown,” states Debra Wright Ottawa Real Estate Board’s 2021 President. “However, while the market normalized in the latter part of the year, looking at the year-end figures, 2021 was still a record-breaking year,” she adds.

emic lockdown,” states Debra Wright Ottawa Real Estate Board’s 2021 President. “However, while the market normalized in the latter part of the year, looking at the year-end figures, 2021 was still a record-breaking year,” she adds.

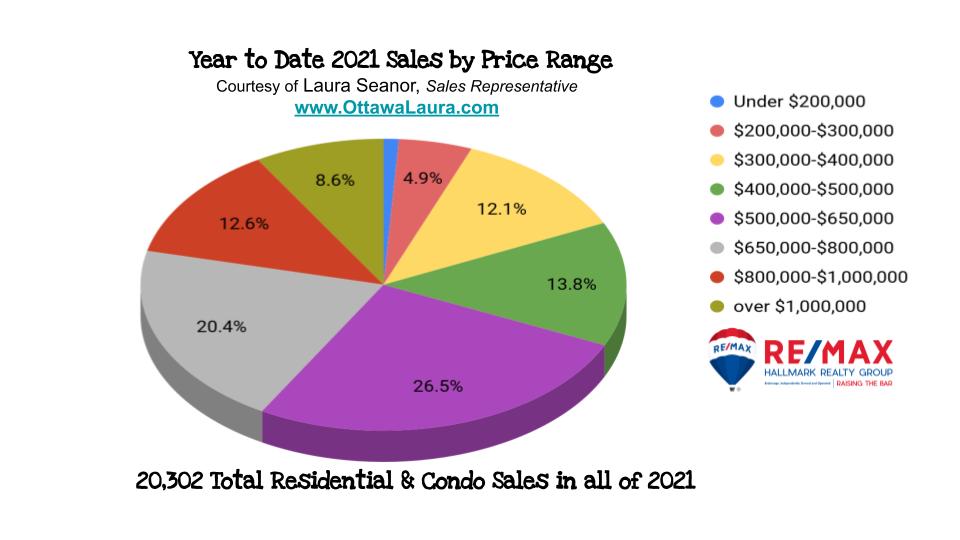

The total number of residential and condo units sold throughout 2021 was 20,302, compared with 18,953 in 2020, increasing 7 per cent. Meanwhile, total sales volume in 2021 was approximately $13.1B compared to $10B in 2020.

“This significant increase in sales volume reflects the price acceleration that we have seen over the last year and correlates with average sale price increases for the city,” Wright elaborates.

“As we have reiterated for the past few years, Ottawa’s housing inventory challenges have been and will continue to place an upward pressure on prices. Reviewing the year-end figures for 2021, the average sale price year to date was $719,605 for residential-class properties and $419,683 for condominium units. These values represent a 24 per cent and 16 percent increase over 2020, respectively.”

The average sale price for a condominium-class property in December was $399,125, an increase of 12 per cent from 2020, and the average sale price for a residential-class property was $709,980, increasing 18 per cent from a year ago.*

“Six hundred new listings entered the housing stock in December, which represents a 58% decrease from November and down 15% from the 5-year average. At less than one month’s supply of units in both the residential and condominium property classes, we are firmly entrenched in a strong Seller’s market and will continue to be in this state until our inventory increases to a 3-4 month’s supply for a balanced market to be achieved,” cautions Wright.

When asked for a forecast, Ottawa Real Estate Board’s new 2022 President Penny Torontow suggests, “January through March are usually slower months. With the macro factors that are currently at play in the resale market, it is difficult to predict what the effects will be going forward. We are entering yet another pandemic wave, Buyers are fatigued, parents are focusing on remote learning, interest rate hikes are looming – I don’t expect we will see the first quarter increases as we did in 2021.”

“We are unlikely to see the true outcome of these macro factors until the spring. Presumably, we will see more of the same with the market performing as well as it can with the current housing stock. Unfortunately for homebuyers, it will sustain itself as a Seller’s market for quite some time until our inventory issues are remedied. Whether you are buying or selling a home right now, the experience and knowledge of a REALTOR® is essential in this current challenging market,” Torontow concludes.

OREB Members also assisted clients with renting 4,813 properties since the beginning of the year compared to 3,364 in 2020.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.