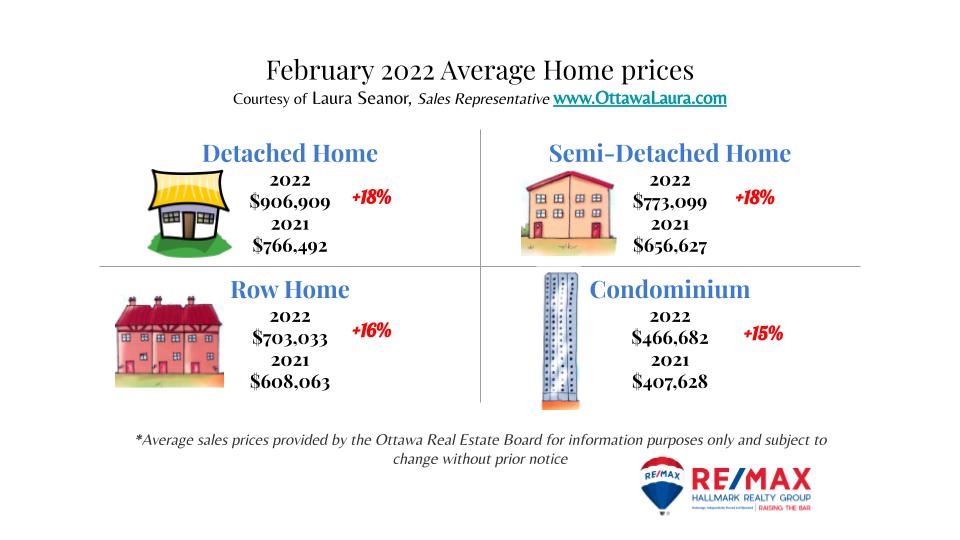

PRICES:

+18% for single family homes

New Average: $906,909

+15% for condos

New Average: $466,682

+16% for Row homes

New Average :$703,033

+18% for Semi-detached

New Average: $773,099

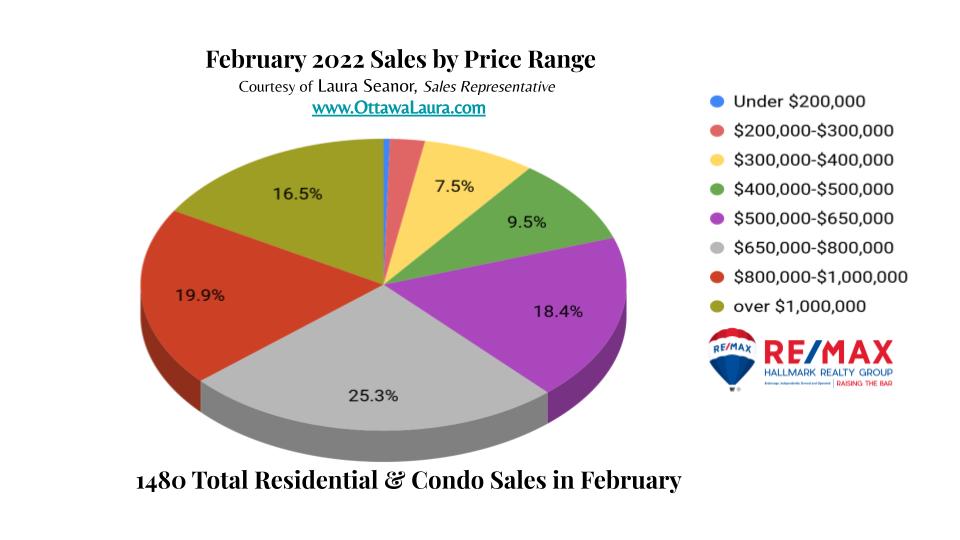

Only 20% of properties were under the $500,000 price point.

We saw a 7% increase in sales over the $1M price point.

SUPPLY:

1762 new listings came to market this past month.

This is the first time since 2018 we have seen over 1700 new listings in February.

However the supply of condos was down 20% from previous years.

DEMAND:

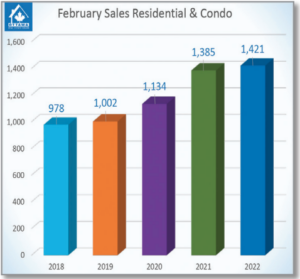

1420 residential properties sold in February

This is a lot, to put it in perspective, this about 400 more properties than 5 years ago.

While it’s positive that we are seeing more listings, these properties are getting snapped up very quickly.

The Absorptions rate (the rate at which new properties are sold) has increased over January 2022

January 2022 – 48% absorption rate

February 2022 – 55% absorption rate

What to expect in this month?

In like a lion, out like a lion. March will certainly move like a lion however I don’t expect it to slow down towards the end of the month.

We should continue to see more properties come to market however that absorption rate usually goes up during the spring months. This means bidding wars, and probably plenty of them.

If you are thinking of moving in the next 3-6 months, reach out and we will review the market in your neighbourhood, have your house prepped, staged and ready to list. We will then focus on finding you the right house, in the right neighbour and making smart, strategic moves. Maximizing your time, energy and profit.

I’m here to help!

Laura Seanor

RE/MAX Hallmark Realty Group🏡

________________

Ottawa 30 second Real estate market update

Do you have questions about what it takes to successfully sell or buy in Ottawa, Canada? DM me or text/call 613-290-0407

OTTAWA, March 3, 2022 -Members of the Ottawa Real Estate Board sold 1,421 residential properties in February through the Board’s Multiple Listing Service® System, compared with 1,385 in February 2021, an increase of 3 per cent. February’s sales included 1,095 in the residential-property class, up 7 per cent from a year ago, and 326 in the condominium-property category, a decrease of 10 per cent from February 2021. The five-year average for total unit sales in February is 1,184.

OTTAWA, March 3, 2022 -Members of the Ottawa Real Estate Board sold 1,421 residential properties in February through the Board’s Multiple Listing Service® System, compared with 1,385 in February 2021, an increase of 3 per cent. February’s sales included 1,095 in the residential-property class, up 7 per cent from a year ago, and 326 in the condominium-property category, a decrease of 10 per cent from February 2021. The five-year average for total unit sales in February is 1,184.

“Although February’s resales were only 3% higher than last year at this time, we saw a 52% increase in the number of transactions compared to January’s figures (936). While a month-to-month increase is typical for this time of year, the gradation of this increase is higher than previous years, which could be an indication that our spring market may ramp up earlier this year,” states Ottawa Real Estate Board President Penny Torontow.

“Whether this has to do with the easing of government pandemic restrictions and the opening up of the economy or perhaps due to apprehension of the (then) upcoming interest rate increase, which is now in effect, we can’t entirely be sure,” she adds. “We are watching intently to see how the 2022 spring market will play out considering not only the higher interest rates and inflation but also other macro factors in our global environment that could affect our local economy.”

“Undoubtedly, the interest rate increase along with the higher rate of inflation will weaken potential Buyers’ purchasing power. And even though average price growths are not as acute as they were in the past two years, we are still seeing significant increases that are without question a result of the unrelenting high demand and current housing stock scarcity.”

The average sale price for a condominium-class property in February was $466,682, an increase of 15 per cent from 2021, while the average sale price for a residential-class property was $837,517, increasing 17 per cent from a year ago. With year-to-date average sale prices at $812,813 for residential and $458,107 for condominiums, these values represent a 16 per cent increase over February 2021 for both property classes. *

“The number of new listings in February (1,762) offers a slight glimmer of hope for prospective Buyers. At 4% higher than the five-year average and 12% higher than February 2021, it resulted in an almost 10% increase in residential-class property inventory compared to last year at this time. Condominium supply, however, is down 20%. Overall, we are now at a 0.7 month’s supply of inventory which means that most listings that enter the market are going to be snapped up very quickly, as evidenced by the continuous decline in Days on Market (DOM). We certainly hope this trend of increased new listings will continue to supplement the housing stock going forward,” Torontow acknowledges.

“Ottawa is a beautiful city with a healthy, stable economy and is a utopic place to work, live and play. It attracts Canadians from other cities and people from all over the world. But it is deeply entrenched in a Seller’s Market. This means homebuyers need to have all their ducks in a row and are prepared to move expeditiously. A REALTOR® will have the knowledge to ensure you are making your best offer at the optimal time. Sellers also need the experience and resources a REALTOR® brings to ensure they are strategically positioning their homes given the conditions of their neighbourhood and property type. Don’t gamble with what is likely your biggest asset – contact a professional REALTOR® today!”

In addition to residential sales, OREB Members assisted clients with renting 800 properties since the beginning of the year compared to 674 by February 2021.

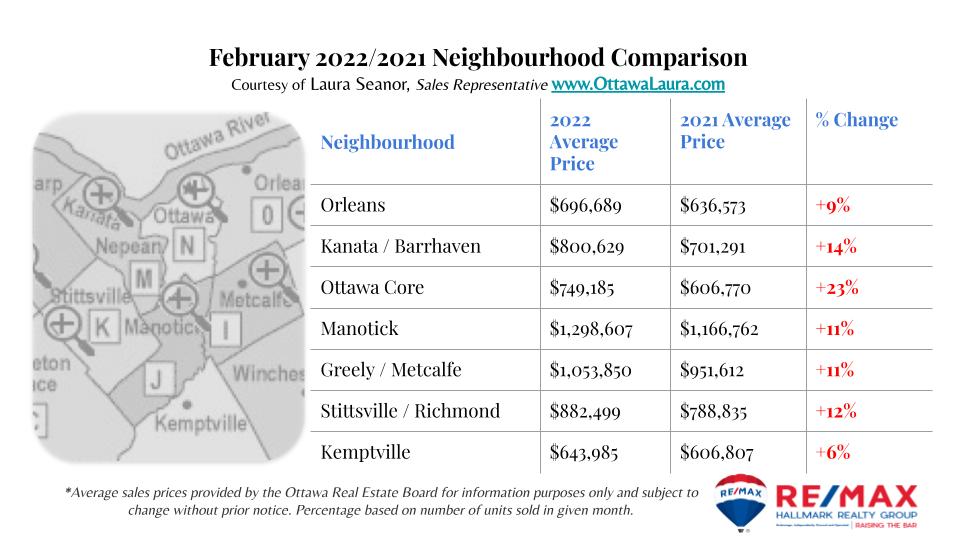

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.