Ottawa 30 second Real estate market update

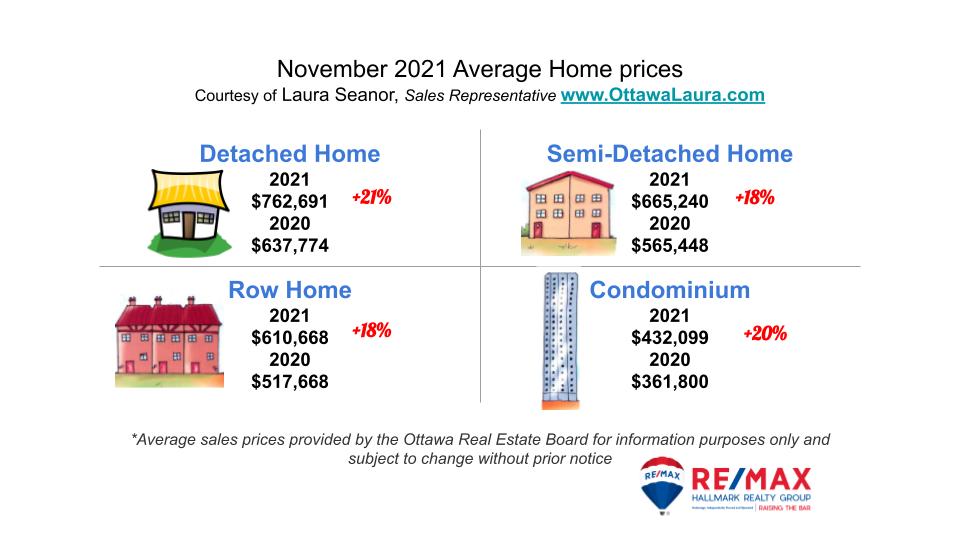

PRICES:

Prices have continued to increase year over year

+21% for single family homes

+20% for condos

+18% for Row homes

+18% for Semi-detached

SUPPLY:

1430 New Listings

*about 30 homes more than the 5 year average

DEMAND:

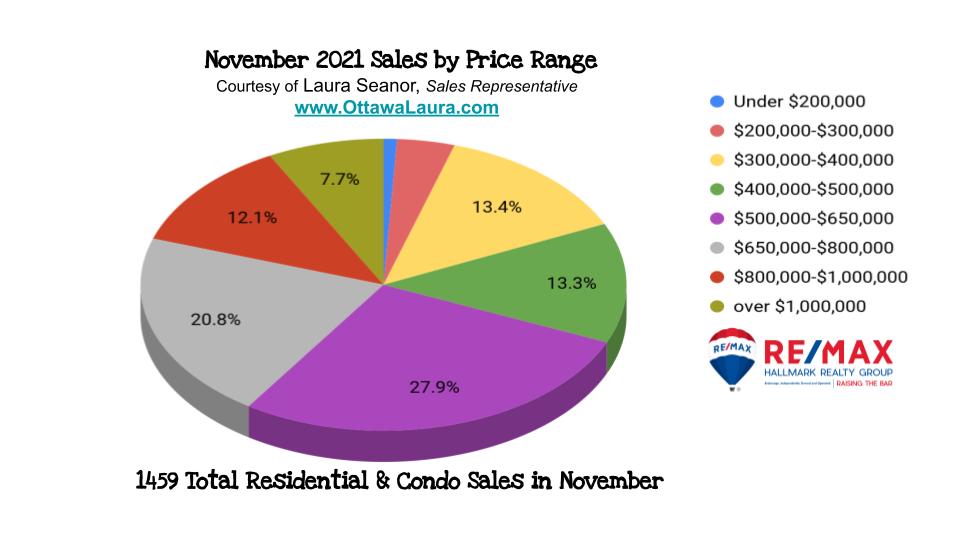

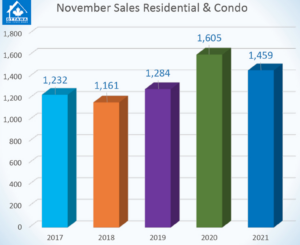

1459 residential properties sold in November

8% higher than the 5 year average

What it means

For the 3rd month in a row we have seen the absorption rate increase

The total absorption rate – the # of homes that sell out of what is available (until we are sold out)

37% in September

42% in October

45% in November

What to expect in this month?

Sellers need to be priced right, prepped and staged. Don’t worry, I will walk you though it and have the proven process in place for you 😉

As the holidays approach, new listing (the supply) will continue to decrease. I am already seeing the number of offers increase in multiple offers again.

It’s never too early to start planing. RE/MAX is expecting a 9% increase in the 2022 year.

With the interest rates going up, it’s a good time for buyers who are thinking of buying in the spring market to start getting their pre-approvals organized.

If you are thinking of selling in the next 3-6 months, reach out and we will review the market in your specific neighbourhood and create the strategic based on when you want to sell to maximize your time, energy and profit.

I’m here to help!

Laura Seanor

RE/MAX Real Estate 🏡

________________

Ottawa 30 second Real estate market update

Do you have questions about what it takes to successfully sell or buy in Ottawa, Canada? DM me or text/call 613-290-0407

November’s Brisk Resale Market

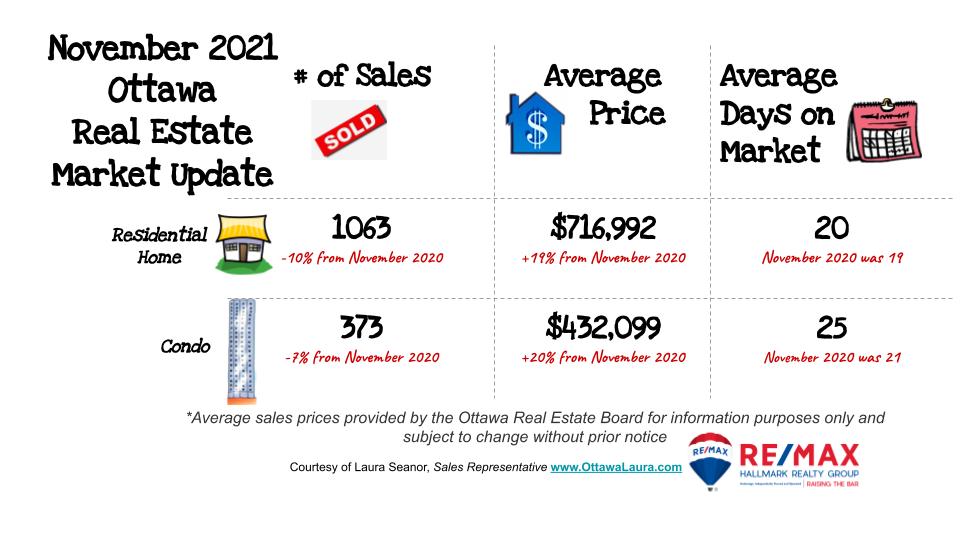

Members of the Ottawa Real Estate Board sold 1,459 residential properties in November through the Board’s Multiple Listing Service® System, compared with 1,605 in November 2020, a decrease of 9 per cent. November’s sales included 1,086 in the residential-property class, down 10 per cent from a year ago, and 373 in the condominium-property category, a decrease of 7 per cent from November 2020. The five-year average for total unit sales in November is 1,348.

“Although the resale transactions in November were down compared to a year ago, this is because 2020’s peak market activity shifted to later in the year due to the initial pandemic lockdown. In reality, November’s unit sales tracked 14% higher than 2019 (1,284), a more relevant base year for comparison,” states Ottawa Real Estate Board President Debra Wright.

“Furthermore, the number of properties that changed hands in November was 8% higher than the five-year average. And we also see an 8% increase in year-to-date sales over 2020, so it is fair to say that the resale market remains active and brisk.”

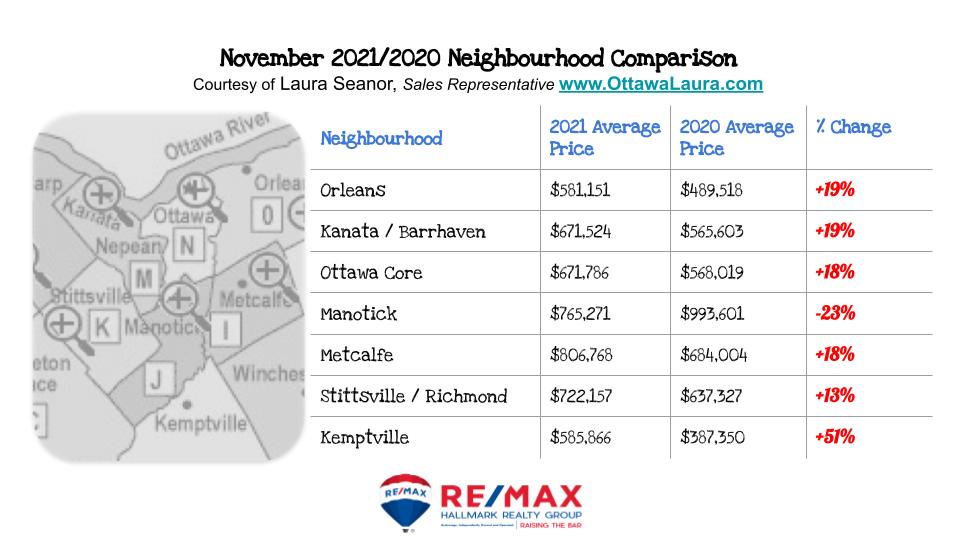

The average sale price for a condominium-class property in November was $432,099, an increase of 19 per cent from 2020, and the average sale price for a residential-class property was $716,992, also increasing 19 per cent from a year ago. With year-to-date average sale prices at $719,956 for residential and $420,762 for condominiums, these values represent a 24 per cent and 16 percent increase over 2020, respectively.*

“Despite significant increases in average prices over November 2020, month-to-month price accelerations have tapered off slightly, with average prices for residential units on par with October’s and condo average prices increasing by 7%. This is a far better situation than the monthly price escalations we had seen in the first quarter of 2021,” suggests Wright. “However, there is no question that supply constraints will continue to place upward pressure on prices until that is remedied.”

“While the drop in volume of new listings is typical for November, our inventory, at one month’s supply, is much lower than it should be. 1,430 new listings entered the market last month, a 27% decrease from October (1,960) and 13% less than last November (1,635). While still 30 or so units over the five-year listing average, this is simply not sustainable and is taking us further away from the balanced market that will bring much-needed relief to potential Buyers,” Wright cautions.

“Whether you are on the buying or selling side of the transaction, this is not the occasion to go at it alone and hope for the best. An experienced REALTOR® is vital in navigating the challenges of this complex market to ensure you are making the optimal choices for what may be the most critical contract you will sign and remain obligated to for the next 20 to 30 years.”

OREB Members also assisted clients with renting 4,458 properties since the beginning of the year compared to 3,120 at this time last year.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood