Ottawa Real Estate Market Update, January 2023

Bidding wars are back? Not on every property, but some

However, I have seen that winning bids have conditions which protect the buyers.

My prediction for next month is that the amount of inventory will start to increase. Prices are going to level out somewhere between 2021 / 2022 price points.

The biggest opportunity for buyers is having more choices and being allowed the time to do their proper diligence.

Sellers will see a major opportunity to stand out and showcase their home to its ideal buyer.

This means in order to win as a buyer or seller you:

- ✅You need to know the market.

- ✅You need to have a strategic plan.

- ✅You need to execute that plan.

Conveniently this is where I come in! I’m here to ease the burden and minimize that overwhelm you’re feeling. I’ll guide you through this entire process step by step, from start to finish.

I am starting to see fixed interest rates back to the mid-4% AND the number of showings booked on properties has increased each week of January.

If you want to make a move, let’s create your plan!

Laura Seanor

Ottawa Realtor®

RE/MAX Hallmark® Realty Group🏠

________________

Ottawa 30-second Real estate market update

Do you have questions about what it takes to sell or buy in Ottawa, Canada successfully? Fill in the contact form and let’s chat.

Ottawa Market Data, The Numbers

Price

Residential Prices ⬇️ 12% from last year

Average Price: $676,272

Condominium Prices ⬇️8 % from last year

Average Price: $412,244

Supply

Total Inventory – ⬆️

January 2023, we had 3578 properties available for sale

January 2022, we only had 1948 properties.

To be fair, this was really low…in Comparison, in Jan 2019, we had 4061 properties available for sale

Demand

Total # of Sales – ⬇️

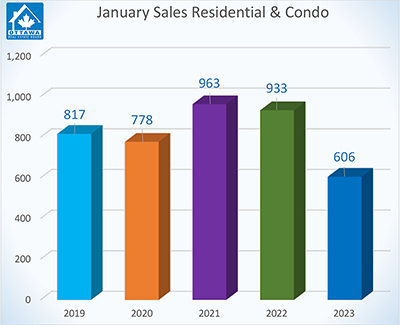

606 sales for the month of January. The latest interest rate hike might have scared some buyers back to the sidelines.

OTTAWA, February 2, 2023 – Members of the Ottawa Real Estate Board (OREB) sold 606 residential properties in January through the Board’s Multiple Listing Service® (MLS®) System, compared with 933 in January 2022, a decrease of 35%. January’s sales included 460 in the freehold-property class, down 30% from a year ago, and 146 in the condominium-property category, a decrease of 47% from January 2022. The five-year average for total unit sales in January is 819.

“January’s marked slow down in unit sales over 2022 indicates potential home buyers are taking their time,” says OREB President Ken Dekker. “While last month saw the culmination of the succession of interest rate hikes announced by the Bank of Canada, affordability remains a factor. They may be waiting for a shift in listing prices. They’re being cautious in uncertain conditions.”

|

By the Numbers – Average Prices*:

- The average sale price for a condominium-class property in January was $412,244, a decrease of 8% from 2022.

- • The average sale price for a freehold-class property was $676,272, decreasing 12% from a year ago.

“Despite the decrease in average prices, the market should not be considered on a downward slide,” says Dekker. “A hyper COVID-19 seller’s market is now leveling out to our current balanced market state.”

“On a positive note, in comparison to December’s figures, January’s average price of freehold properties increased by 3%. The average price of condos did fall by 5% compared to December but condo pricing tends to fluctuate more due to the small data set.”

By the Numbers – Inventory & New Listings:

- Months of Inventory for the freehold-class properties has increased to 3.8 months from 0.9 months in January 2022.

- Months of Inventory for condominium-class properties has increased to 3.8 months from 0.8 months in January 2022.

- January’s new listings (1,324) were 16% higher than 2022 (1,142) and up 89% from December 2022 (699). The 5-year average for new listings in January is 1,233.

“Ottawa’s inventory and days on market figures are typical for a balanced market and another sign that buyers are no longer racing to put in an offer,” says Dekker. “The increase in new listings and supply is a boon for home buyers, who now have more selection and the ability to put in conditions at a less frantic pace. REALTORS® are an essential resource in finding the right property for the right buyer. On the other side of the transaction, REALTORS® can help sellers with hyper-local insights about how to sell in their neighbourhood at a time when pricing is key.”

More people are turning to REALTORS® for help renting properties — 509 this month compared to 410 in January 2022, an increase of 24%. “Even with the increase in housing stock, the tighter rental market is another indication that affordability is keeping some potential buyers on the sidelines.”