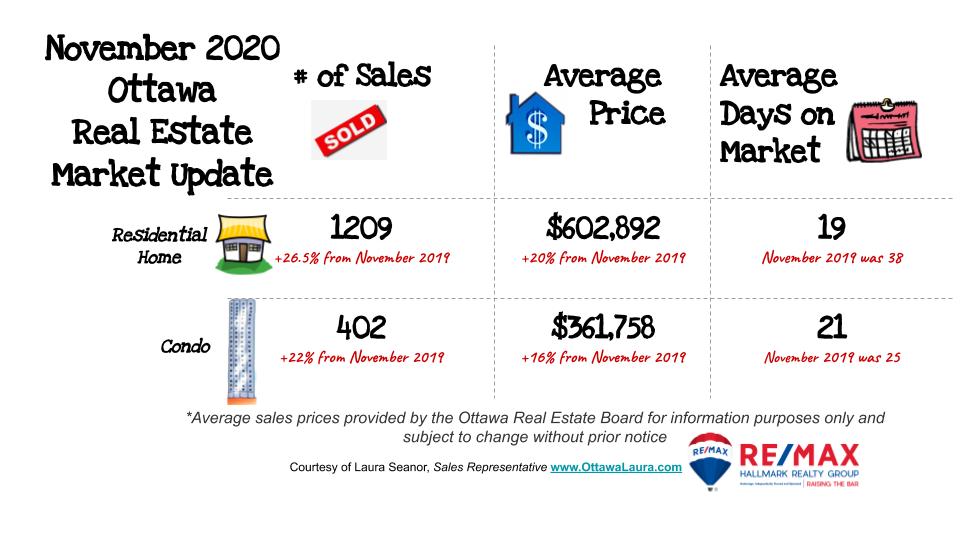

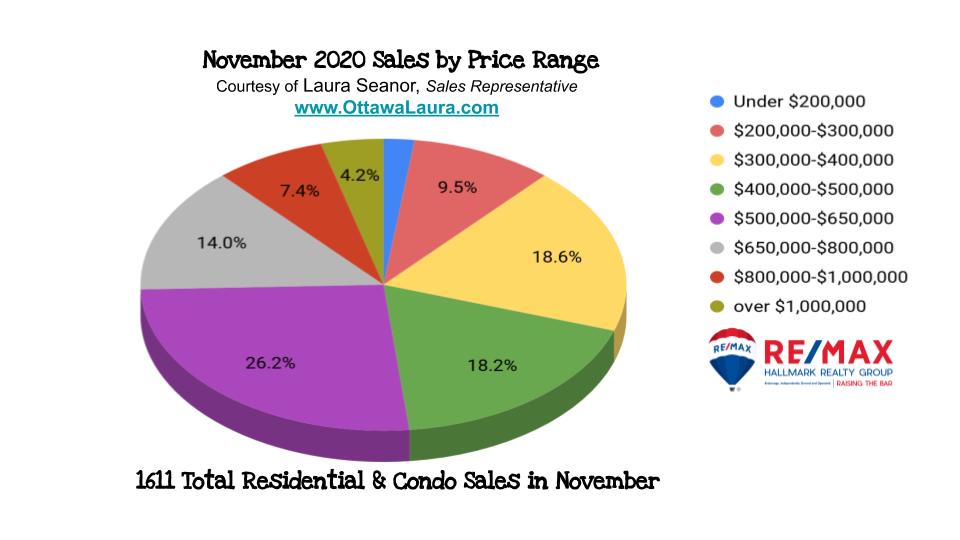

December 3, 2020 Members of the Ottawa Real Estate Board sold 1,611 residential properties in November through the Board’s Multiple Listing Service® System, compared with 1,284 in November 2019, a year over year increase of 26 per cent. November’s sales included 1,209 in the residential-property class, up 27 per cent from a year ago, and 402 in the condominium-property category, an increase of 23 per cent from November 2019. The five-year average for November unit sales is 1,257.

“We continue to experience strong activity in Ottawa’s resale market during the time of year when we would typically see a slowdown,” states Ottawa Real Estate Board President Deb Burgoyne. “Further, the pandemic overall did not slow down the resale market, and our year to date transactions are now on par with 2019.”

“I’m confident in saying that if we had more supply, sales would be even higher. Although new listings were up almost 400 units compared to last November and over 225 properties higher than the five-year average, there were 1,000 fewer new listings entering the market than we saw in October. Listings coming on in November do typically slow as potential Sellers turn their attention to the upcoming holiday season,” Burgoyne adds.

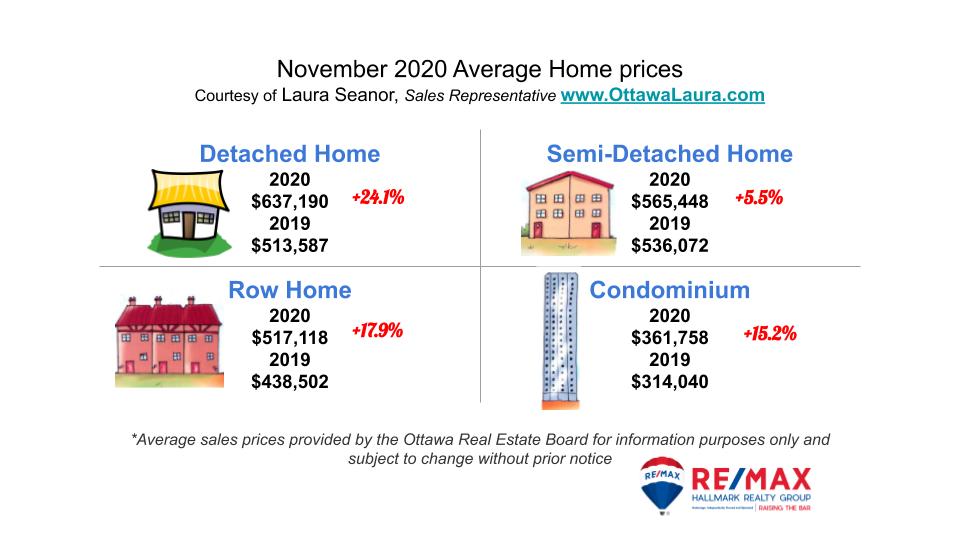

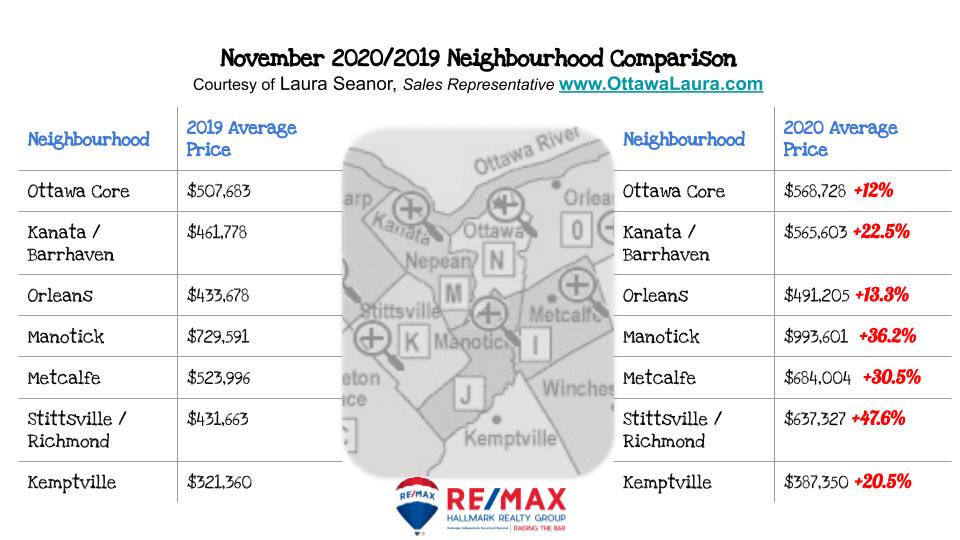

November’s average sale price for a condominium-class property was $361,758, an increase of 15 per cent from this time last year, while the average sale price of a residential-class property was $602,892, an increase of 20 per cent from a year ago. With year-to-date average sale prices at $581,120 for residential and $361,674 for condominiums, these values represent a 20 per cent and 19 percent increase over 2019, respectively.*

“As far as average prices go, year to date prices are a more reliable indicator of what property values are doing over time, especially when we look at figures from the final quarter of the year. In November 2018, we saw a 3-5% gain in YTD average prices; a year later in 2019, they were up 9% for both property classes. Now in 2020, YTD average prices are 19-20% higher. This trajectory can be attributed to a concurrent decrease in inventory, which continues to be a challenge in our active market. The residential housing stock is 50% lower than last year at this time.”

“Interestingly, the number of condominiums on our MLS® System has actually increased 25% over last November,” Burgoyne notes. “As I stated last month, condos continue to be on our watchlist. This property type is staying on the market longer. The increase in these listings is likely a combination of factors. Investor owners who have been renting their units can now capitalize on the robust market, while some Buyers are seeking more space or other lifestyle options. For example, transitioning to working remotely is providing some Buyers with the opportunity to explore their lifestyle property preferences. Whether it be small town vs downtown living, a recreational property with acreage, be closer to golf courses or waterfront, rural spaces or hobby farms – it opens up the options beyond the classic property types of condominiums or single-family homes in suburbia.”

“Now more than ever, Buyers and Sellers will benefit from the knowledge and experience of a REALTOR®. Our resale market continues to experience multiple offers and bidding wars, and you would want the guidance of someone who has maneuvered through this many times. Particularly if you are looking at purchasing a recreational property, which have become very desirable in the past 6 months or so. These properties’ considerations are different than those you are used to seeing in the city, such as wells, septic tanks, conservation considerations, etc. A professional REALTOR® can explain these features to you, so you don’t risk any surprises down the road,” Burgoyne cautions.

In addition to residential and condominium sales, OREB Members assisted clients with renting 3,120 properties since the beginning of the year compared to 2,559 at this time last year.

* The Board cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price and conditions will vary from neighbourhood to neighbourhood.