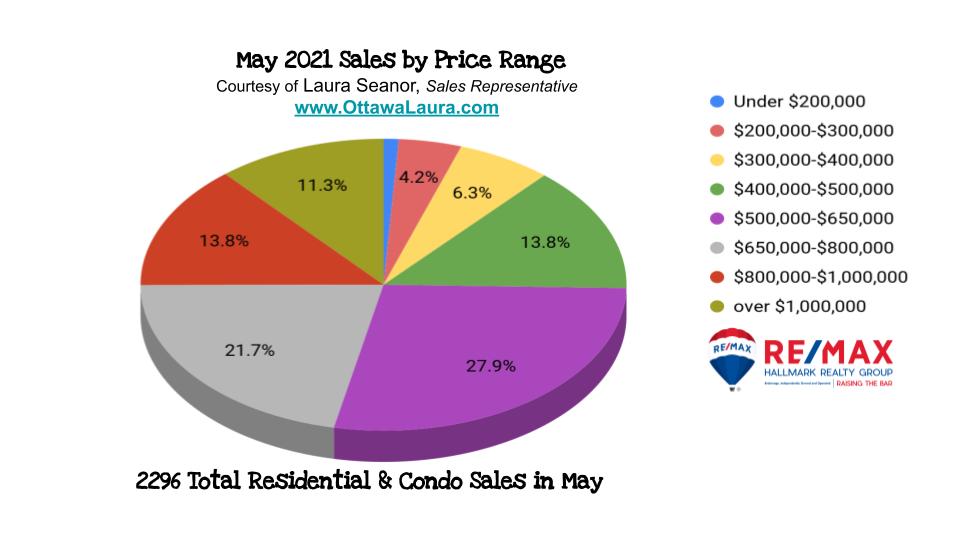

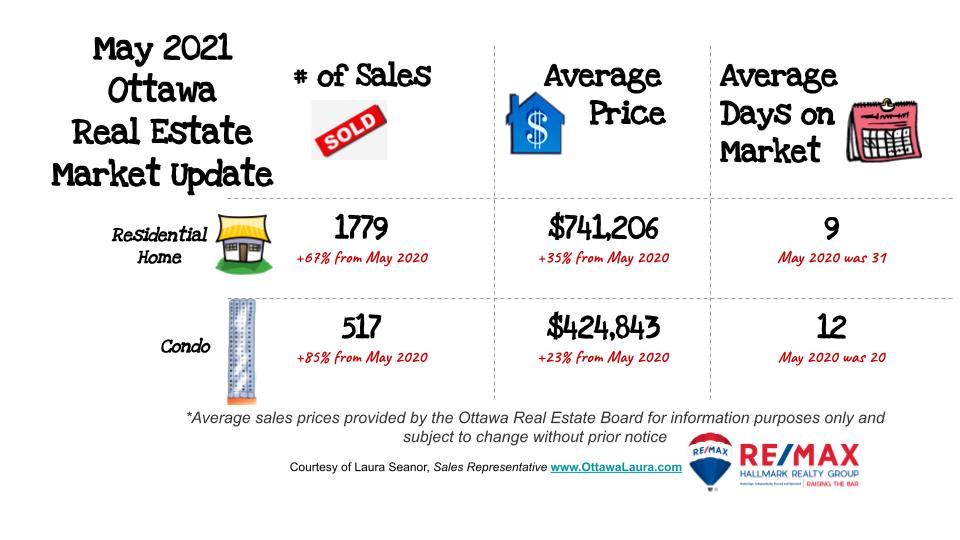

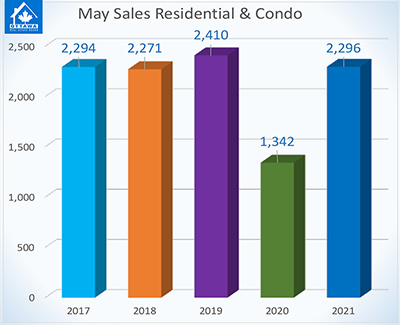

OTTAWA, June 3, 2021 – Members of the Ottawa Real Estate Board sold 2,296 residential properties in May through the Board’s Multiple Listing Service® System, compared with 1,342 in May 2020, an increase of 71 per cent. May’s sales included 1,779 in the residential-property class, up 67 per cent from a year ago, and 517 in the condominium-property category, an increase of 85 per cent from May 2020. The five-year average for total unit sales in May is 2,123.

“Although Ontario was in a lockdown in both May 2020 and May 2021, the impact they had on Ottawa’s resale market was quite different – with this year’s number of transactions being well over the five-year average. Undoubtedly, enhanced safety measures and vaccine adoption rates have enabled potential Buyers and Sellers to feel more protected and comfortable in their home buying and selling process,” states Ottawa Real Estate Board President, Debra Wright.

“Additionally, twice the number of new listings entered the market in May 2021, compared to last year at this time, with 2,386 residential properties and 727 condos added to inventory. This is approximately 50 units more than the five-year average for new listings,” she adds.

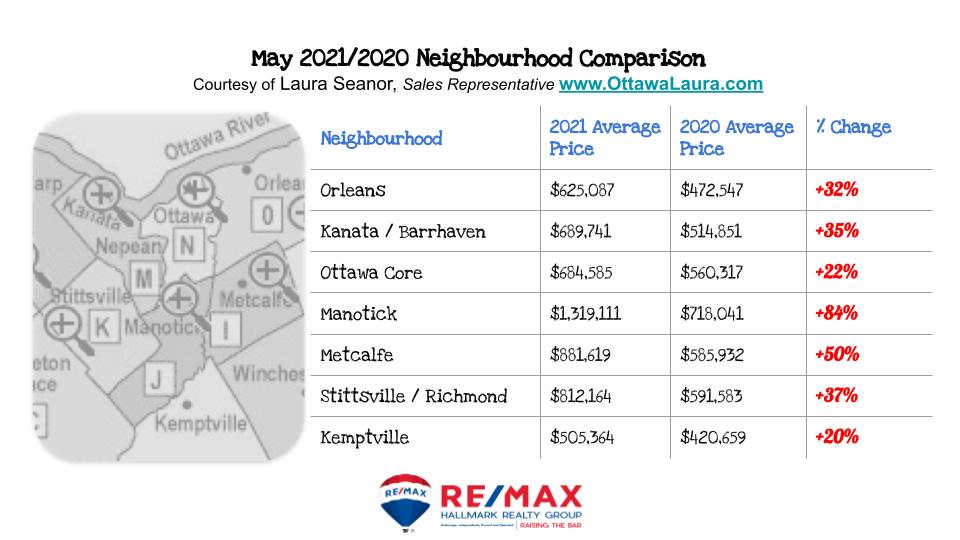

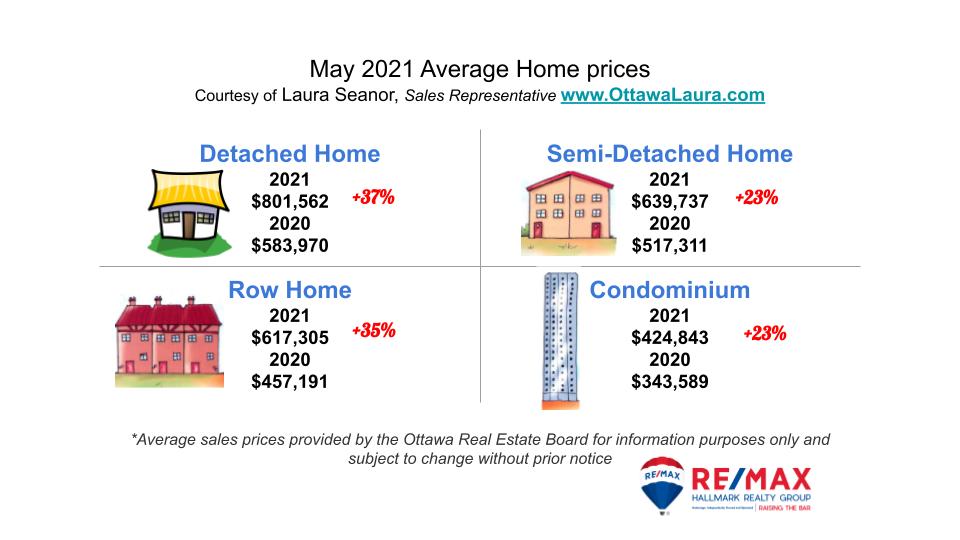

May’s average sale price for a condominium-class property was $424,843, an increase of 24 per cent from last year, while the average sale price for a residential-class property was $741,206, an increase of 35 per cent from a year ago. With year-to-date average sale prices at $736,241 for residential and $420,074 for condominiums, these values represent a 35 per cent and 21 percent increase over 2020, respectively.*

|

“With the number of condominium sales transactions having increased by 85% in May of 2021, over May of 2020, coupled with the 21% price increase in the same periods, it appears that the condo market has recovered from the declines experienced early in the pandemic.”

“For residential-class properties, price movement is still well above 2020, with 46% selling over $700K compared to 16% of properties last year at this time – these percentages are reflected in the sales data for both May and year-to-date. We observe that month-over-month average price increases for April and May are not as high as the jumps in value in the first quarter of 2021. While it is still too early to predict, this may be a sign that the rapid price acceleration we have been experiencing is easing in the market.”

“As we come out of this lockdown, we will closely monitor other market factors including the effects of the increased stress test measures combined with the average five-year fixed mortgage rates climbing back over two per cent since the beginning of 2021, and whether pent-up supply will decrease our supply shortage and eventually bring Ottawa’s real estate market to a more balanced state,” Wright concludes.

OREB Members also assisted clients with renting 1,837 properties since the beginning of the year compared to 1,207 at this time last year.

* OREB cautions that the average sale price can be useful in establishing trends over time but should not be used as an indicator that specific properties have increased or decreased in value. The calculation of the average sale price is based on the total dollar volume of all properties sold. Price will vary from neighbourhood to neighbourhood.